Information-Only Resource

Interest-Free & Akhuwat

Loan Information in Pakistan

At getfastt.info, we delineate how Akhuwat-inspired, interest-free microfinance paradigms underpin community support in Pakistan. Our independent, information-only guides address loan-related eligibility factors, customary documentation, and indicative timelines so you can make informed choices. This portal serves purely as an educational resource on loans and does not operate as a lender or application conduit.

Processing remains contingent upon verification protocols; indicative timelines are institution-specific and may diverge across organisations.

Akhuwat Loan Scheme — Comparative Information & Non-Broker Guidance

At getfastt.info, we outline how Akhuwat’s community-based, interest-free loan models are described in public materials. Timelines can vary with eligibility and verification, and some welfare programs reference flexible disbursement windows. These processes are administered directly by Akhuwat and other authorised organisations. Our role is strictly educational—no lending, brokering, or application handling.

How Akkhuwat Welfare-Based Schemes Typically Work

This material is provided as a general overview for knowledge purposes only. For accuracy and current requirements, always confirm directly with the relevant official organisations.

Initial Interest & Eligibility

Explore the program’s overall purpose, its intended beneficiary groups, and the basic eligibility criteria—such as residence status, income brackets, and community references.

Documents

Keep on hand the documents usually asked for—such as CNIC, proof of residence, income and expense records, and any supporting community references (requirements may differ by organisation).

Community Appraisal

Trust-based microfinance models may involve local verification, reference checks, and a domiciliary or enterprise-site visit to assess need and repayment capacity.

Review, Decision & Disbursement

Applications are assessed directly by the organisation. Upon approval, funds and repayment parameters are communicated; actual timelines vary according to programme structure and verification processes.

Our Mission & Vision

Our Misson

At getfastt.info, we share accurate, easy-to-understand information on welfare-based loan programs (including Akhuwat-inspired models). We explain eligibility, documents, and typical timelines so you can apply directly with official providers—this site is information-only and does not process applications.

Our Vision

At getfastt.info, our vision is to build a trusted knowledge hub where communities across Pakistan can learn about loan-related eligibility requirements, documentation norms, verification practices, and repayment structures in clear, accessible language.

Who Can Benefit

ChatGPT said:

Public programs address varied needs—from students seeking tuition/exam support to micro-business owners requiring seed or working capital, households managing healthcare or emergencies, and families with housing requirements. At getfastt.info, we provide independent, information-only guidance on loan-related eligibility, common documents, and indicative timelines. Information-only.

Students

Tuition, books, exam fees (program-dependent).

Micro-Entrepreneurs

Seed capital & working capital support.

Households

Healthcare & emergency needs.

Housing

Construction/renovation (where applicable).

Why These Models Matter

Interest-free financing has the potential to empower households and small enterprises while also reinforcing bonds of mutual trust within communities.

0% markup; Shariah-aligned intent.

Community and trust-based verification.

Focus on dignity, inclusion, and opportunity.

Education, micro-enterprise, healthcare & housing support.

Guides & Resources

Eligibility & Documents

- CNIC (Computerised National Identity Card)

- Proof of residence (recent utility bill or tenancy/rental agreement)

- Income verification and/or guarantor particulars (programme-dependent)

Note: Requirements may vary by organisation and locality. getfastt.info is an independent, information-only resource.

How Verification Works

- Community-based appraisal and/or references are common.

- Verification may include employment status, household income, and character checks.

- Objective: confirm a genuine applicant within the programme’s stated criteria.

- Timelines vary—from expedited reviews to several weeks, depending on verification.

Note: getfastt.info is an independent, information-only resource.

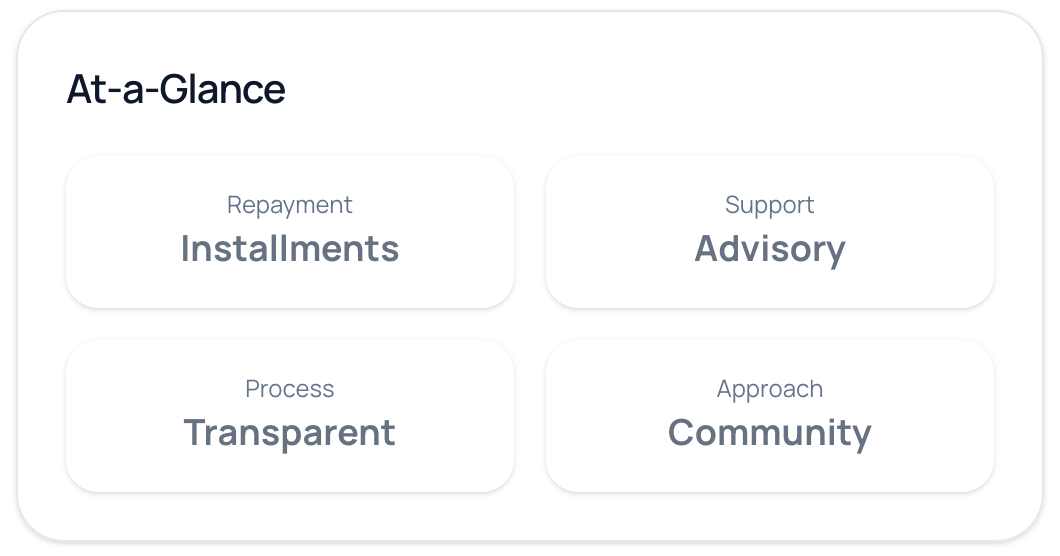

Interest-Free Repayment

Installments: Repayment is typically structured in small, manageable instalments.

No interest/markup: The total repaid equals the original loan amount (interest-free).

Good standing: Timely repayments may support eligibility for future assistance.

Defaults: Late or missed payments can affect access to subsequent programmes.

Note: getfastt.info is an independent, information-only resource.

What People Say

Real experiences from Pakistan — our guidance helped them understand the process and apply with the official organisations.

-

★★★★☆

“Their information clarified where to start and how to review the steps before visiting the official office.”

Ahmed RazaLahore -

★★★★★

“I was unsure about the documents; they broke the usual list down, step by step, and it finally made sense.”

Ayesha KhanKarachi -

★★★★☆

“Their pointers helped me organise paperwork and understand what verification might include.”

Bilal AhmedRawalpindi -

★★★★★

“The information was clear and practical, which made the overall process easy to follow.”

Fatima NoorFaisalabad -

★★★☆☆

“Without their tips, I might have overlooked important requirements along the way.”

Hassan AliMultan -

★★★★☆

“WhatsApp responses were prompt and courteous for general information queries.”

Rabia MalikHyderabad -

★★★★★

“I learned useful details about Akhuwat-style, interest-free programmes here that I hadn’t seen elsewhere.”

Salman YousafPeshawar -

★★★★☆

“Yahān mujhē Akhuwat-inspired options ki wazih samajh ā’ī — yeh bohat madadgār maloomati resource hai.”

Mehwish TariqQuetta -

★★★☆☆

“First time exploring these programmes; they explained the direction clearly and calmly.”

Usman SiddiqSialkot -

★★★★☆

“Timelines and requirements were clarified, so preparing my documents was faster.”

Hira QureshiBahawalpur -

★★★★★

“Best part: they’re information-only — transparent, neutral, and reliable.”

Hamza IqbalGujranwala -

★★★★☆

“Strictly information-only, yet extremely helpful for understanding what to ask next.”

Sana JavedSukkur -

★★★★☆

“A crisp roadmap for micro-entrepreneurs; it helped me assemble a sensible checklist.”

Imran RafiqKasur -

★★★★★

“Their content clarified categories, eligibility basics, and general terms.”

Komal ShahLarkana -

★★★☆☆

“Repayment guidance gave me confidence to visit the official office well-prepared.”

Zeeshan ArifSahiwal -

★★★★☆

“They explained how to prepare correctly; decisions are always handled by the official organisation.”

Nida RahmanMardan -

★★★★☆

“I now understand the rules and verification steps that were unclear before.”

Waqar HussainSheikhupura -

★★★☆☆

“Their guidance helped me approach the official help desk with the right questions.”

Mariam ZafarAbbottabad -

★★★★☆

“No gimmicks — just straightforward information that actually helps.”

Farhan WaheedJhelum -

★★★★★

“The documents and verification checklist here made my planning much smoother.”

Bushra KhalidWah Cantt

*Information-only. We do not provide, arrange, or accept applications. All decisions and timelines belong to the official organisations.*

Frequently Asked Questions

As an independent knowledge hub, getfastt.info provides guidance on how welfare-based/interest-free loan programmes operate, the associated eligibility criteria, and sources of official information. We do not arrange, approve, or provide loans; all applications are handled directly by the relevant official organisations.

Timing for financial assistance is set by the official organisation’s internal workflow. Factors such as eligibility review, community appraisal, and document verification govern overall speed—sometimes relatively quick, sometimes longer. getfastt.info is an independent, information-only resource; we do not control approvals or timelines.

As an independent knowledge hub, getfastt.info is not affiliated with Akhuwat or any bank, NBFC, or NGO. We provide educational content on how welfare-based and interest-free loan models generally operate in Pakistan. Programme references (including Akhuwat) are for informational purposes only; all trademarks, names, and formal procedures remain the property of their respective organisations.

Eligibility is set by the organisation administering the programme. In general, students, small business owners, households, and individuals with limited income may qualify, subject to each institution’s own rules. Because criteria differ by provider, always review the official guidelines before applying. getfastt.info provides general knowledge only about loan-related processes—we do not assess or determine eligibility.

Most programmes typically ask for a few common documents, such as:

Valid CNIC (Computerised National Identity Card).

Proof of residence (recent utility bill, tenancy/rental agreement, or equivalent).

Evidence of income and/or a guarantor, depending on the specific scheme.

Note: Requirements can differ between organisations. Always confirm directly with the official institution before applying. getfastt.info is an independent, information-only resource.